Simplify Your U.S.Tax Filing as a Non-Resident

Let us help you if you are –

- U.S. sourced income

- U.S. Corporations with Foreign Owners

- Foreign-Owned U.S. Single-Member LLCs

- Foreign Corporations Engaged in U.S. Trade or Business

Initial Consultation

We assess your tax residency status, income sources, and filing requirements.

Document Collection

Our team gathers all necessary documents, including Form W-2, Form 1042-S, and other income records.

Tax Treaty Analysis

We review applicable tax treaties to minimize your tax liability.

Form Preparation

We prepare and file the appropriate tax forms, such as Form 1040-NR (Nonresident Alien Income Tax Return).

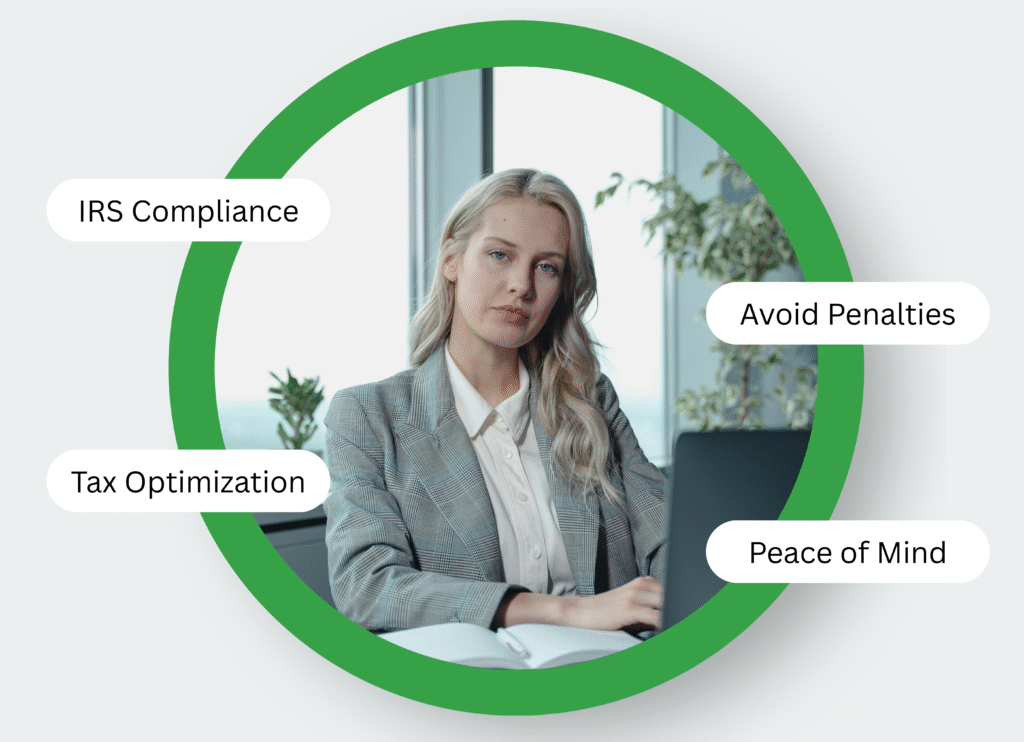

Why You Need Non-Resident Tax Filing Services

Avoid IRS Penalties & Legal Issues

Filing incorrectly or missing deadlines can lead to $500+ in penalties and IRS audits. We ensure 100% compliance

Maximize Tax Savings & Deductions

Reduce your tax burden with expert guidance on tax treaties, deductions, and exemptions.

Simplified Filing for Businesses

Whether you own a U.S. LLC, rental property, or earn freelance income, we manage all required tax forms (1040-NR, 5472, etc.).

Peace of Mind

Rely on experts to handle the complexities of non-resident tax filings.

Simple investment for everything your business needs

Whether you’re an individual, a small team, or a growing enterprise,

we have a plan that aligns perfectly with your goals.

Basic

- IRS-Certified Tax Preparer

- Optimized Tax Strategies

- 100% Compliance Assurance

- Fast, Secure E-Filing

- Foreign-Owned U.S Single Member LLC

Pro

- IRS-Certified Tax Preparer

- Optimized Tax Strategies

- 100% Compliance Assurance

- Fast, Secure E-Filing

- Foreign-Owned U.S Multi-Member LLC

Requirements for Non-Resident Tax Filing

To file your non-resident tax return, we’ll need

- Personal details (name, address, and tax ID such as ITIN).

- Documentation of U.S.-sourced income (W-2, 1042-S, or other forms).

- Details of any tax treaty benefits you may qualify for.

- Expenses or deductions related to your U.S. income.

- Non-resident individuals with rental income or other U.S. income sources.

What Makes Our Service Stand Out

Personalized Assistance

Tailored services to meet your unique tax situation.

Tax Treaty Expertise

Maximize savings by leveraging applicable treaty benefits.

Accurate Filing

Avoid errors with our professional tax preparation.

Stress-Free Process

Let our experts handle the paperwork and filing requirements.

Why We’re the Right Choice for You

Experienced Professionals

With years of CPA experience, we've helped countless clients secure their ITINs.

Efficient Service

We ensure your return is filed accurately and on time.

Transparent Pricing

Clear, upfront pricing with no hidden fees.

Global Reach

Specialized services for international clients with U.S. tax obligations.

Frequently Asked Questions

Do I need to file a U.S. tax return as a non-resident?

If you earned income from U.S. sources or meet other filing criteria, you are required to file a U.S. tax return, typically using Form 1040-NR.

What is a tax treaty, and how can it benefit me?

A tax treaty is an agreement between the U.S. and another country to prevent double taxation. We analyze treaties to determine if you qualify for reduced rates or exemptions.

Can I claim deductions as a non-resident?

Yes, certain deductions may be available, depending on your income sources and tax treaty benefits.

What happens if I miss the tax filing deadline?

You may face penalties and interest for late filing or payment. Contact us to file as soon as possible and minimize penalties.

Can you help me get an ITIN?

Yes, we assist non-residents in obtaining an ITIN (Individual Taxpayer Identification Number) if needed for tax filing.